Queensland’s Infrastructure Outlook: Key Insights from the 2024 Major Projects Pipeline Report

The Queensland Major Projects Pipeline Report (QMPPR) for 2024 provides a comprehensive snapshot of major engineering and construction activities shaping the state’s infrastructure landscape over the next five years. While the report, developed in partnership with Oxford Economics Australia and other key industry players, forecasts a promising horizon for project investments, it also highlights critical challenges and considerations.

In his analysis, Darren Cave looks at what the next 5 years mean for the Sunshine State and a ‘golden decade’ of infrastructure investment.

A Bright, Yet Complex Outlook

With a pipeline valued at a record $103.9 billion, major infrastructure activities in Queensland are set to surge, particularly from 2025/26 through 2027/28. This forecast signals robust growth, driven largely by investments in transport, water, and energy infrastructure. Projects tied to the 2032 Brisbane Olympic and Paralympic Games are among the pivotal contributors to this expected activity boost. However, the rise comes with caveats, as the overall growth is tempered by constraints such as funding uncertainties, regulatory bottlenecks, and escalating construction costs.

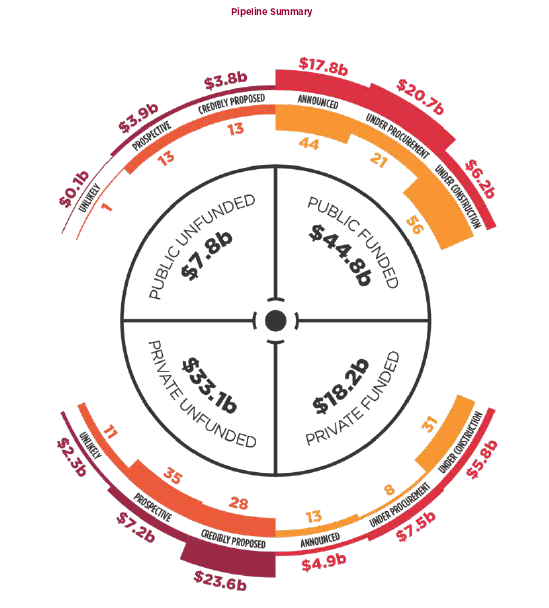

Funding Realities: Balancing the Funded and Unfunded

The QMPPR highlights a critical gap: while $62.4 billion worth of projects are funded, an estimated $41.6 billion remains unfunded—a 10% increase compared to last year. This unfunded portion represents a substantial risk to project continuity and underscores the urgency for improved funding mechanisms, streamlined approval processes, and strategic partnerships between public and private sectors.

Regional Disparities and Mega Projects

Significant variation exists across Queensland’s regions. Areas like Cairns, Brisbane, and the Gold Coast have seen reductions in funded projects, while Wide Bay leads with substantial investments such as the Borumba Pumped Hydro Project. The trend toward mega projects (valued at over $1 billion) is noteworthy, as these make up 58% of funded pipeline activity. While beneficial for economic impact, this trend raises concerns about access for smaller contractors, who may struggle to engage with such large-scale developments.

Rising Costs and Labour Challenges

Cost escalation remains a pressing issue. Though international factors have somewhat eased, domestic pressures—primarily driven by labour and material costs—continue to inflate project budgets. The engineering construction price index grew by 4% in 2023/24. Furthermore, a tightening labour market, marked by high demand for skilled workers, poses risks to project timelines and costs. Innovative solutions to attract and train new talent are vital for sustaining the sector’s growth.

Collaboration and Planning are Key

To ensure Queensland’s infrastructure vision becomes a reality, effective collaboration between industry and government is paramount. Optimising procurement, aligning regulations, and adopting a coordinated approach to public and private investments are essential strategies. These measures will not only foster value-for-money outcomes but also enable the industry to meet ambitious targets and navigate economic fluctuations.

Critical Sectors

Within the sectors Lidiar Group supports, there are positives across the board, but the challenges of resources, labour, skills and funding seen across the entire sector are clearly apparent in this area.

Electricity Sector

- Significant Investment: Queensland’s pipeline for electricity projects is largely driven by investments in renewable energy, highlighting the state’s commitment to transitioning to clean energy sources. Renewable electricity generation projects make up a notable portion of the overall major projects pipeline.

- Labour Demand: Due to the geographic distribution of renewable projects, regions such as Fitzroy, Wide Bay, and Mackay–Isaac–Whitsunday will experience heightened labour demands.

- Challenges and Opportunities: The transition to renewable energy infrastructure in Queensland reflects a period of change, with challenges around workforce availability and skills development in regional areas where projects are being delivered.

Pipelines and Telecoms

- Utility Growth: The non-water utilities sector, including pipelines and telecoms, contributes significantly to the funded portion of the major project pipeline. This sector is characterised by strong private-sector involvement, which is vital for delivering on Queensland’s infrastructure goals.

- Funded and Unfunded Status: A considerable share of pipeline projects within this sector remains unfunded, posing risks and uncertainties, especially in terms of long-term project delivery and investment stability.

- Infrastructure Needs: Investment in telecommunications infrastructure supports regional connectivity and growth, aligning with broader goals for integrated infrastructure solutions across Queensland.

Mining and Heavy Industry

- Concentration in Regions: The Fitzroy and Mackay–Isaac–Whitsunday regions, heavily focused on mining and heavy industry, account for 55% of total unfunded work. The sector faces notable risks related to global commodity market fluctuations and investment regime shifts.

- Private Sector Dominance: The private sector leads this industry’s projects, making up 50% of private unfunded work in the pipeline.

- Infrastructure Challenges: Mining projects often experience delays due to complex regulatory and approval processes, emphasising the need for strategic government and industry collaboration to streamline investment pathways and approvals.

Conclusion: The Path Ahead

As Queensland braces for an era of transformative development, industry stakeholders must rise to the challenge of balancing growth, efficiency, and inclusivity. By addressing funding gaps, engaging all tiers of the industry, and enhancing productivity, the state can capitalise on its rich project pipeline to create a lasting legacy, and Lidiar Group looks forward to supporting our clients and projects with resources, skilled personnel and end-to-end project experience.